The troubled cryptocurrency exchange FTX was breached a few days ago. Elliptic, a blockchain forensics company, recently published an article highlighting the removal of various tokens on Ethereum, BNB Smart Chain, and Avalanche. About $477 million of the $663 million lost is thought to have been stolen, while the rest was probably put into safekeeping by FTX.

Developers and other members of the community quickly began to worry that FTX’s Serum protocol, which is based on Solana, had also been hacked. Since the original Serum could only be updated with a private key tied to FTX, developers required a second version. The Serum DAO was not in possession of the key.

Solana’s NFT marketplace Magic Eden has adopted a new royalty structure based on optional payments.

Consequently, the team decided to proceed with the emergency fork despite the fact that the FTX hack could have compromised that key. The fork’s leader, the anonymous developer Mango Max, confirmed this. The developer also emphasized that LPs could use Serum as a central order book to backstop liquidations on Solana.

Liquidity aggregators are currently developing and testing their integrations. Some time ago, Jupiter stated that it was live-testing the new version’s integration and “will announce it as soon as it is ready.”

As the developer Mango Max explained, other community projects like Solape DEX, OpenSerum, and Switchboard were working to integrate with the fork. Mango Markets, in fact, are also in the same camp. It recently tweeted confirmation of this,

A community fork of Serum will be implemented in Mango v4.

Sentiment-Check, Price movements

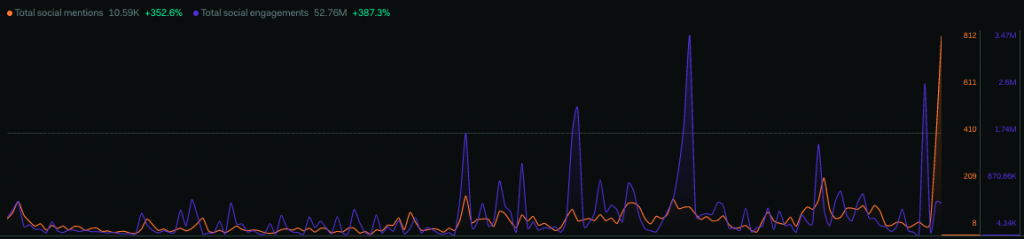

There has been considerable talk about Serum on social media sites like Twitter. Social mentions and engagements have increased by 352% and 387% respectively over the past week, according to data collected by LunarCrush.

After the FTX hack, the value of Serum’s native token, SRM, plummeted and its prospects dimmed. However, following the split, the asset’s value began to rise again. As of this writing, the token had begun to recover. As of this writing, SRM was trading at a price 175% higher than its low on November 13.

However, SRM is still in a precarious position. Despite the recent 175% surge, long-term investors are still down money. At press time, one token cost about $0.33, a far cry from its all-time high of $12.98 or its all-time low of $13.73 from last year.

Disclaimer: This isn’t financial advice; it’s just for education. Crypted Crypto can’t guarantee its accuracy. Every investment and trade carries some risk, so always do your own research. Invest only what you can afford to lose.

READ ALSO:

Leave a Reply