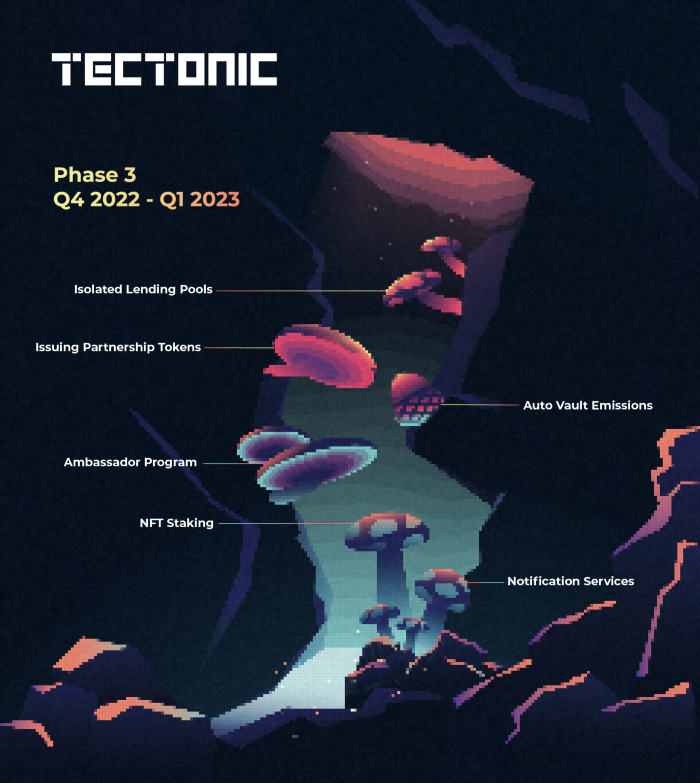

”We’re happy to announce our plans for the next three to six months as our anniversary approaches. Here, we’ve laid out a plan of action (Tectonic Roadmap Update) that gives top priority to features that take into account both user needs and suggestions from our community,” says Tectonic Team.

Let’s quickly review what we’ve accomplished so far before we get started!

We accomplished a lot in the last quarter. Some things, on which we are still working with our allies, are listed below. The rollout of “Liquidation Threshold Notifications” is a part of this. We are currently collaborating with the Cronos ID group to broaden this functionality to support additional alert formats (detailed more in the Notifications Services section below).

Isolated lending pools

You asked us to expand to more markets during our August AMA, and we listened. Maintaining our status as the premier lending protocol on Cronos requires us to increase the number of exchanges where our token is listed. The decision to introduce new tokens should not be made hastily, however, as doing so could expose existing token markets to unnecessary risk. Tokens with a smaller market cap, lower on-chain liquidity, and greater volatility are more susceptible to large price swings (and even price manipulation). As a result of these doubts, we have been selective in listing small cap tokens, focusing instead on blue chip assets that have high liquidity and trustworthy price indices.

We’ve been hard at work on launching new lending pools to mitigate these dangers and broaden our scope. These new markets are separate from the markets where you currently supply and borrow. It’s important to note that each pool has its own individual set of parameters, fine-tuned to achieve the optimal risk-reward ratio. Borrowing and lending are constrained to the assets in each pool. Therefore, the assets you contributed to the separate pool can only be used to generate interest or secure loans within the confines of that pool.

Several factors led us to settle on this course of action:

- Security — Users have an extra sense of safety when using isolated pools. This protects the value of assets in other pools because the value at risk is confined to the pool at hand. You Decide at Your Own Risk!

- Expand options to users — Users have more options when they access pools that are not connected to others. As a result, we will be able to introduce more specialized and topical choices for the population as a whole. Users can tailor their portfolio allocations to their risk tolerance and preferred asset classes by selecting from among a variety of pools, each of which may have unique parameters.

We are in the process of developing this feature and have had preliminary discussions with several prospective collaborators. We are looking forward to working with the community to brainstorm new listing and pool ideas, and we can’t wait to tell you about the tokens that will soon be available on Tectonic. Keep reading for updates as they become available!

Issuing Partnership Tokens for higher APYs

As we prepare to launch additional pools, tokens, and strategic alliances, it is important to us that our community of lenders and investors reap the benefits of these new developments. Because of this, we plan to implement the option to receive rewards in tokens other than TONIC. Be on the lookout for increased returns on new token listings as a result of our partnerships with other protocols, which will qualify for these bonuses.

NFT Staking

We are planning to implement partner NFT staking for our maturity vaults after 2022. This enhancement is made with the intention of benefiting both the long-term users of our xTONIC vaults and the various NFT projects within the Cronos ecosystem. Staking NFTs into a preexisting user vault will result in a boost multiplier being added to the standard APR.

In summary:

- You should store your xTONIC in a secure location.

- Put your Non-Fluid Transaction in a Safe

- Gain extra TONIC in proportion to the strength of your NFT boost.

When you stake an NFT, the value of your vested xTONIC increases, giving you a larger proportion of the TONIC emissions. The boost multiplier increases with the amount of xTONIC that you vest or the length of time that it is locked away in a vault.

More information, including which NFTs will qualify, will be made available at a later time while we finish ironing out the feature’s mechanics.

Notifications Services

Auto Vault Emissions

We also hope to implement auto vault emissions to offer our community additional long-term incentives. A portion of your supply and borrowing activity rewards can be converted to xTONIC and stored away automatically. It will decrease opportunistic yield farming and reward those who are in it for the long haul, and users will enjoy higher yield without having to manually click anything. Additional yields in TONIC are provided by our vaults on top of the xTONIC staking rewards, allowing you to earn the highest possible annualized return on your TONIC investment.

Ambassador Program

Finally, we’d like to share with you an important item on our roadmap that isn’t directly related to features: the Tectonic Ambassador Program! This initiative seeks to enlist Tectonic’s most ardent fans as “ambassadors,” whose duties will include community management, user education, and event planning. We’ve heard that you’d like us to do more for the community, and we think this program will be a good way to do it.

This program will officially begin in January 2023, and applications will be sent out shortly. Keep an eye out for this posting on our various social media channels if you’re interested in applying.

Next steps

In addition to the more substantial features discussed above, we plan to make regular updates to the user interface in an effort to further refine our protocol and make it more pleasant to use. We’ll keep shaking things up, and in the meantime, we’d love to hear your thoughts. Anyone interested in forming a business relationship with us is welcome to contact the community managers on the voice chat service Discord.

Disclaimer: This opinion is not meant to be taken as financial guidance and is presented merely for educational purposes. Crypted Crypto cannot guarantee that it accurately represents the views of the publication. You should always do your own research before making any financial decisions, as every investment and every trade carries some degree of risk. If you cannot afford to lose the money you invest, then you should not invest it.

READ ALSO: Top 5 Cryptocurrencies in 2023

Leave a Reply