Data shows that as profit-taking returns to the foreground, Bitcoin is gaining momentum at its current six-week highs.

Glassnode, an on-chain analytics company, has found evidence of previously “dormant” Bitcoin is making a comeback into circulation.

BTC trends out of hibernation

As the BTC/USD pair stages a modest recovery in the second half of October, hodlers are adjusting their strategies following a year-long bear market.

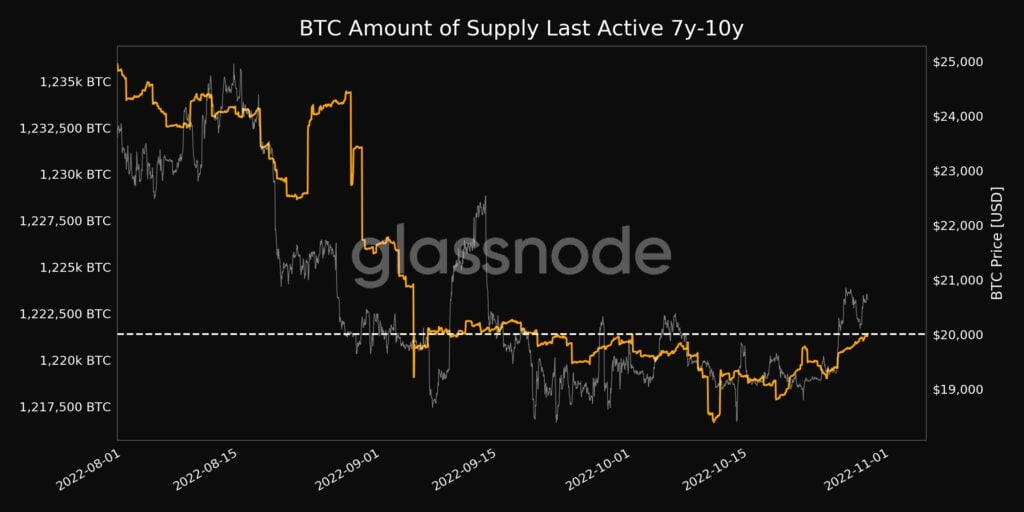

Glassnode reports that the number of dormant Bitcoin in their wallet for 7-10 years hit a monthly high on October 29.

This is the most recent of a string of record highs that began on October 1.

Additional data shows that the percentage of profit remaining in unspent transaction outputs (UTXOs) hit a new monthly high of over 73% on October 28th, with the goal of surpassing September levels.

Glassnode proves that fast Bitcoin transfers are profitable rather than costly.

SOPR spikes through key range

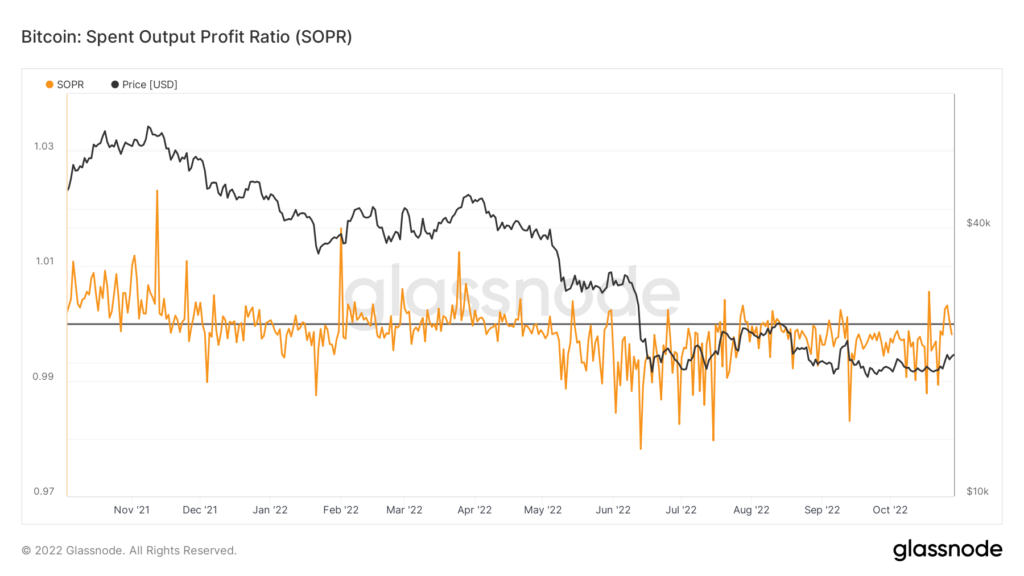

The data supports the theory that, at present prices, even the most seasoned Bitcoin hodlers have a growing desire to engage in profit-taking.

Related: Capitulation or profit-taking? Bitcoin whale moves 32K BTC dormant since 2018

A crucial metric of the network suggests that such activities may increase significantly even if the spot price grows only slightly.

Recent values of Bitcoin’s Spent Output Profit Ratio (SOPR) indicate that a move into classic profit-taking territory for BTC/USD is imminent.

Measured in terms of SOPR, the profitability of the BTC supply is revealed. The ratio fluctuates around 1, with a negative reading during bear markets. A reading above 1 indicates an increase in supply, which may have an effect on prices.

Renato Shirakashi, who developed the metric, introduced it this year by saying, “In a bear market, everyone is selling or waiting for the break-even point to sell.”

“When SOPR is close/greater than 1, people start to sell even more, as they reach break-even. With a higher supply, the price plunges.”

Some on-chain signals, as reported by Cointelegraph, indicate a more nuanced picture overall.

The largest cryptocurrency exchange by trading volume, Binance, saw its Bitcoin balance drop by a record 55,000 BTC in a single day this week.

Continue Reading on Coin Telegraph

Disclaimer: This opinion is not meant to be taken as financial guidance and is presented merely for educational purposes. Crypted Crypto cannot guarantee that it accurately represents the views of the publication. You should always do your own research before making any financial decisions, as every investment and every trade carries some degree of risk. If you cannot afford to lose the money you invest, then you should not invest it.

READ ALSO: Top 5 Cryptocurrencies in 2023

Leave a Reply