Institutions appeared to be avoiding cryptocurrency up until very recently. Several recent articles reported that flows were either negative or slightly positive, illustrating the “tepid investor appetite” that has been prevalent recently.

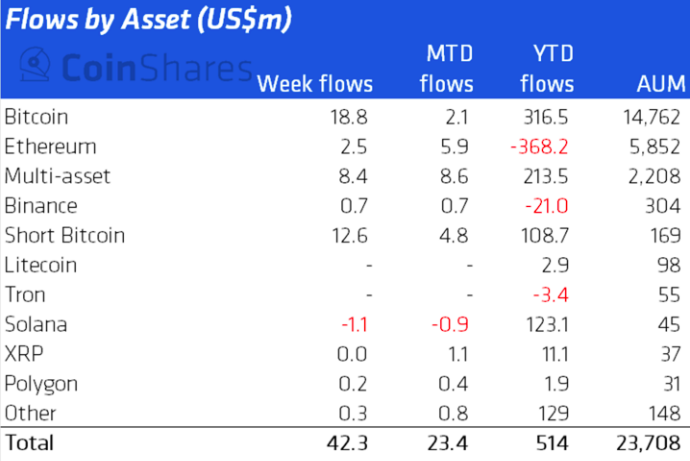

However, it appears that the tide has turned recently. The latest weekly report from CoinShares shows that crypto-related investment products received $42 million, the largest inflow in 14 weeks. The report indicates that

“The inflows began later in the week on the back of extreme price weakness prompted by the FTX/Alameda collapse. It suggests that investors see this price weakness as an opportunity, differentiating between “trusted” third parties and an inherently trustless system.“

Bitcoin led the pack with positive flows of $19 million, the largest since early August. At the same time, people have started coming back to alts. For example, Polygon’s native token MATIC was able to attract institutional interest, resulting in $0.2 million in inflows. In contrast, Binance’s BNB and Ethereum’s ETH both see positive flows of $0.7 million and $2.5 million, respectively.

While this is true, it is also important to note that there has been a large inflow into short Bitcoin products, suggesting that not everyone is optimistic. Also, Solana saw a decline in traffic. To quote CoinShares:

Some investors have been scared off despite the generally upbeat mood.

Is the SEC raining on the parade?

The US Securities and Exchange Commission has been given more time to decide whether or not Bitcoin Exchange Traded Fund (ETF) shares issued by ARK 21Shares can be listed on the Chicago Board Options Exchange BZX Exchange. It issued a statement not too long ago that said,

So that it has enough time to consider the proposed rule change and the issues raised therein, “the Commission finds that it is appropriate to designate a longer period within which to issue an order approving or disapproving the proposed rule change.”

The SEC has put off making a call on this matter before. The deadline for the Commission’s decision on the proposed rule change has been set for January 27, 2023.

It is worth noting that investment funds into cryptocurrencies and related products have been flowing in from all over the world, with the United States being the primary beneficiary. About 82%, or $42.3M, came from the United States.

Delaying regulatory approval for novel investment products proposed by firms like Ark and 21shares at a time when sentiment is gradually refining could therefore prove to be counterproductive.

Source: Watcher.guru

Disclaimer: This isn’t financial advice; it’s just for education. Crypted Crypto can’t guarantee its accuracy. Every investment and trade carries some risk, so always do your own research. Invest only what you can afford to lose.

READ ALSO:

Web3 Is the Future of the Internet -You Need to Know About It

Leave a Reply